- Software to track expenses update#

- Software to track expenses manual#

- Software to track expenses software#

Software to track expenses update#

Once you have chosen a system, update it regularly. Also, consider the system’s cost and user-friendliness to determine how effectively it’ll help you meet your goals.

Software to track expenses software#

Whether you use a spreadsheet, an app or a more comprehensive software solution, setting up an expense tracking system will help drive efficiency in your bookkeeping.Ĭonsider your business’ size and complexity when deciding which system is best for tracking expenses. This is especially helpful if your business has multiple departments or locations. With an automated system, you can easily monitor expenses and streamline invoicing, payments and reports. If you’re tracking expenses manually, it’s easier for things to get missed. Improve visibilityĪ digitised and automated system provides real-time visibility into your business’ financial health, allowing you to identify trends and improve forecasting. And correcting errors can be time-consuming and, therefore, costly to the business.Īutomating expense tracking takes human error out of the picture, ensuring your financial records are accurate by detecting data entry errors and flagging duplicate entries.

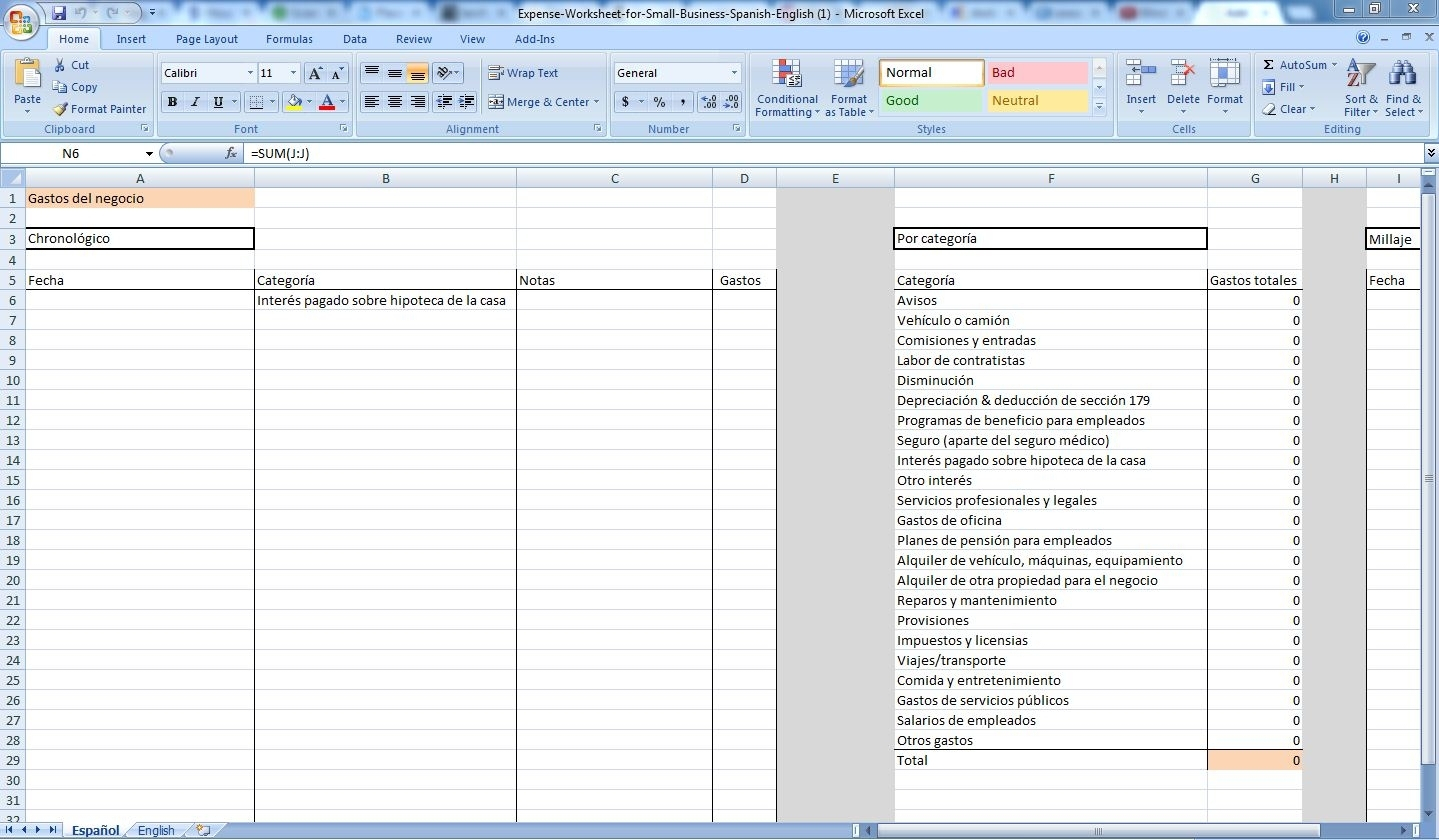

Software to track expenses manual#

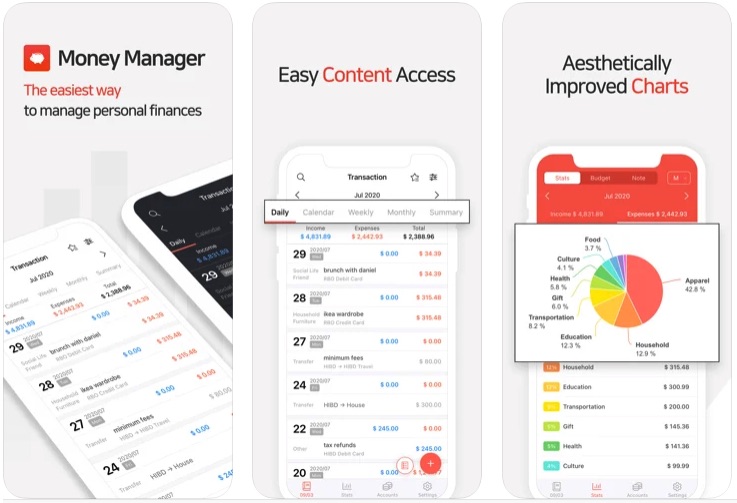

In accounting, manual data entry can lead to mistakes that can throw out your books. Tracking expenses: why automate? Increase accuracy and reduce errors It’s important to note that keeping your receipts manually on-hand can be difficult to manage, leading to lost or missed expenses, data errors and time inefficiencies. This method of expense tracking will quickly be outgrown as your business develops and you find yourself handling more complex payments and business-related expenses. You can use receipt scanning software to make it easier to store and track your paper receipts online. You can track your transactions as they occur or total up your receipts later.ĭon’t forget to keep your receipts and all other financial records in a secure location. When tracking business expenses, record the date, item (or store name), and amount of the purchase. It’s important to note this process can get very time consuming as your business grows, and tasks may duplicate leading to time inefficiencies, human error and more. You may also want to include relevant notes about each expense for your own records, such as who paid for the product or service and why you bought it. When creating a spreadsheet for tracking business expenses, it’s important to include entries for: You can also use formulas to analyse and compare expenditures. Tracking expenses in Excel or other spreadsheet programs like Google Sheets allows you to input data and update it continuously. If you’re a sole trader, the Australian Tax Office (ATO) has an app called myDeductions, which you can use to track expenses and other tax information.īefore selecting accounting software, ensure it complies with Standard Business Reporting (SBR).Īccounting software or a full-scale business management platform is the most comprehensive way to track your spending as well as manage other business-critical processes as your business grows and evolves. Most accounting software programs connect with your bank account. Use accounting softwareĪccounting software is an invaluable resource if you’re looking for a streamlined way to input, track and analyse expenses.

It’s also helpful for budgeting and filing taxes, making it easier to:ģ ways to track expenses 1. Tracking expenses is essential because it helps you keep tabs on how much money you spend and where it’s going. Business expenses are costs you incur to run your business, such as payments you make for advertising, office supplies, software subscriptions and more.

0 kommentar(er)

0 kommentar(er)